What's new - HSBC Online Banking now has a different look and feel. This includes a better interface for your eStatements where you'll find everything you need quickly and easily. The new interface will be rolled out in phases.

You can view up to 3 months 1 transaction advice, as well as eStatements 2,3 from as far back as seven years ago by using online banking or the HSBC HK Mobile Banking app (HSBC HK App). You can even download your old statements via online banking or the HSBC HK Mobile Banking app (HSBC HK App). No more waiting for the post.

Save moneyWhen you opt for eStatements and eAdvices service, you won't have to pay the HKD60 annual fee 4 for paper statements.

Eco-friendlyFewer printouts puts less strain on our local recycling facilities, and ensures less paper ends up in landfills.

ConvenientNo more digging through drawers and filing cabinets for that bank information from way back when. You’ll always have your financial records at your fingertips.

Up to the minuteGet SMS or email notifications when your eStatement or eAdvice are ready, and receive push notifications 5 for new statements of banking accounts on the HSBC HK App when you activate your Mobile Security Key.

Save money. Save time tracking your finances. Save space in your closet. Do it all when you switch to eStatements and eAdvice service.

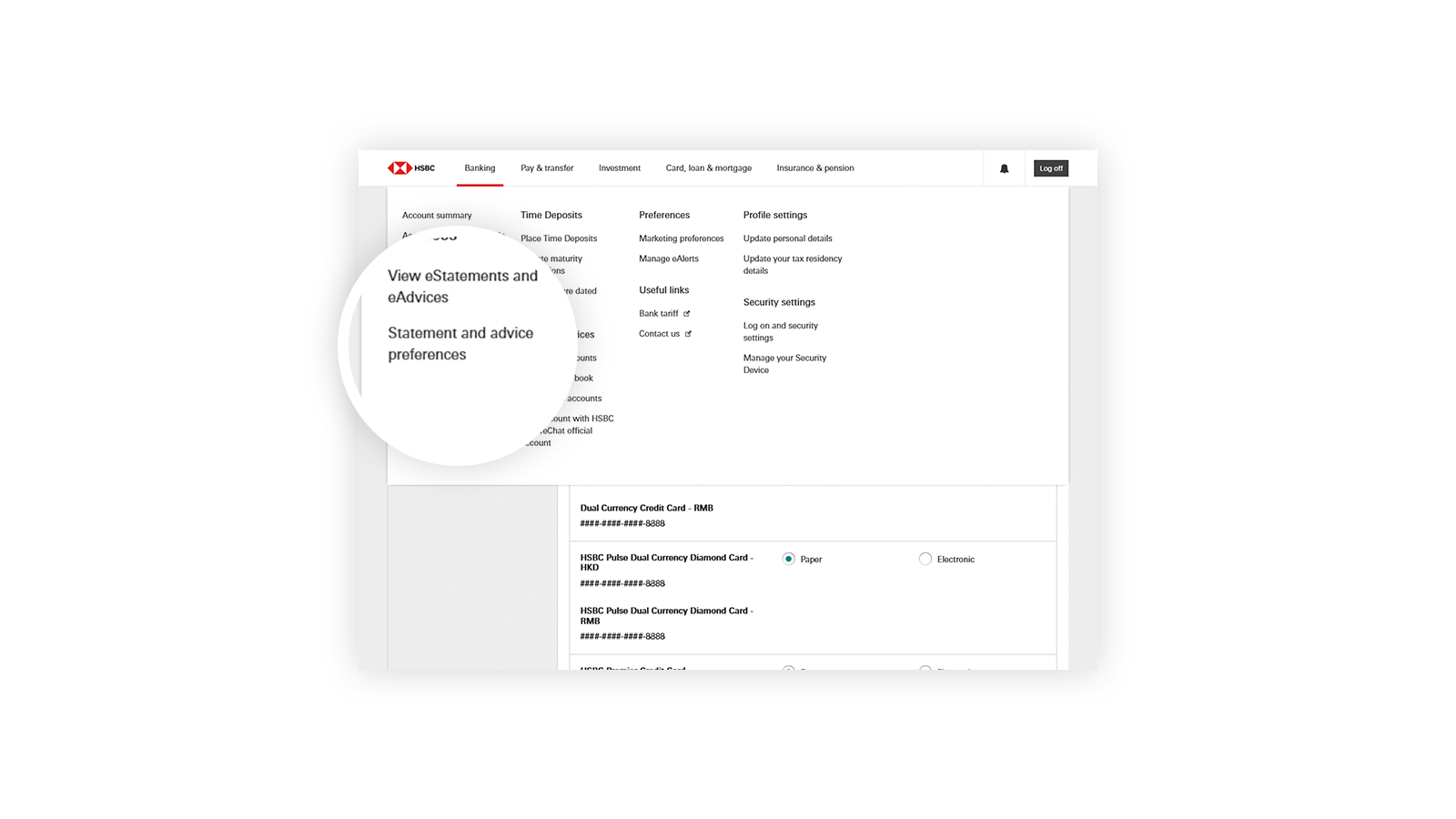

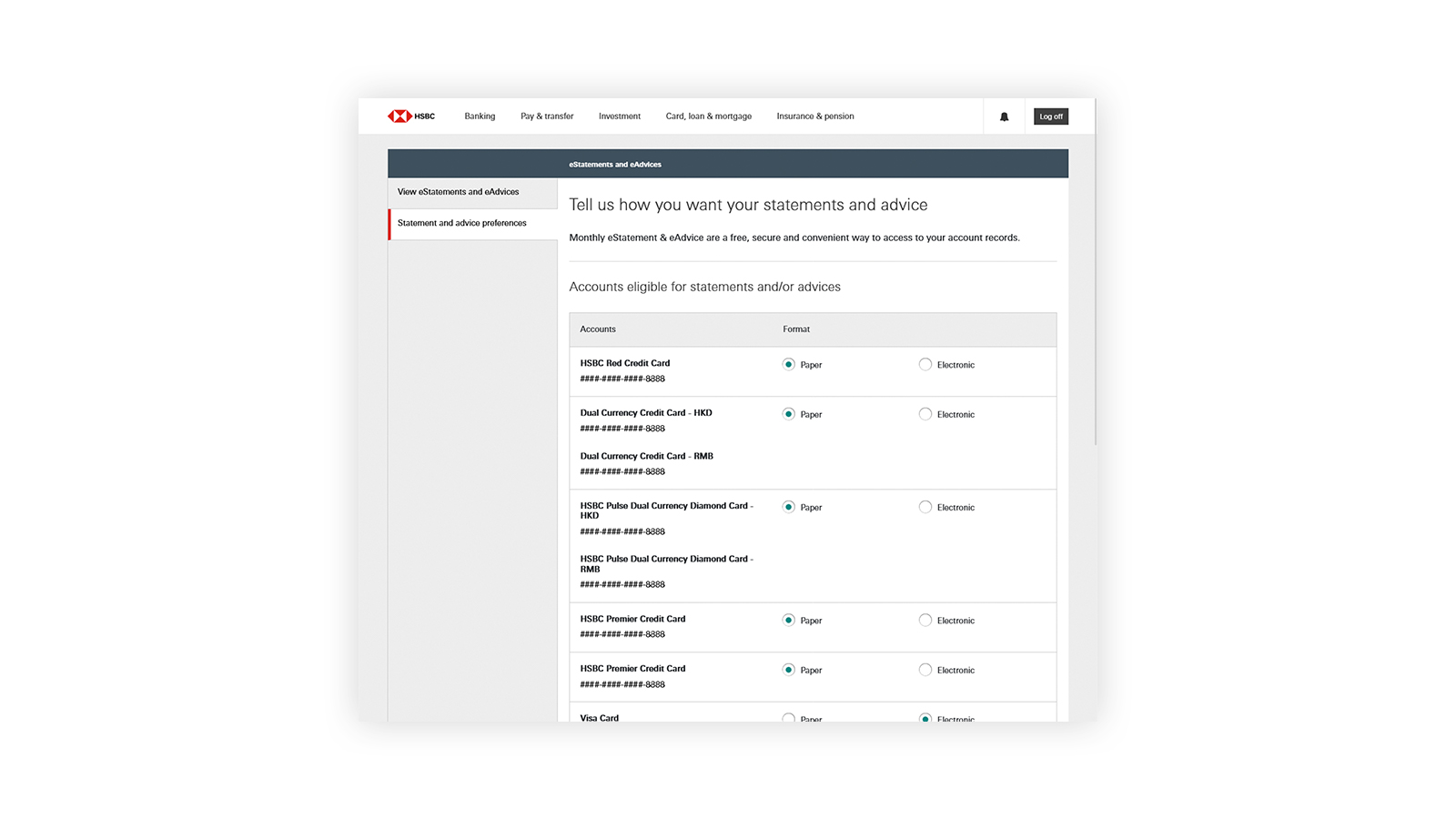

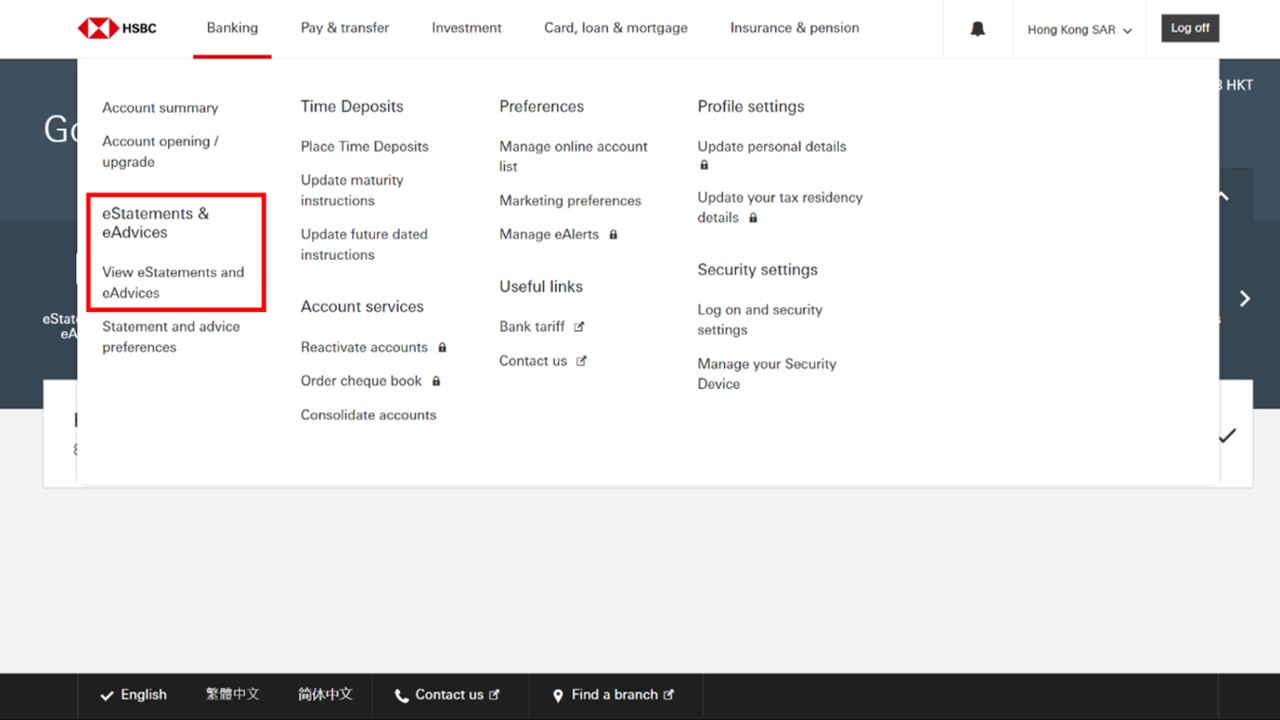

Step 1: Log on to HSBC Online Banking. Hover over 'Banking' on the top menu. Under 'eStatements & eAdvices', select 'Statement and advice preferences'

Step 2: Switch from 'Paper' to 'Electronic', accept the T&Cs and save. You're all set.

Step 1: Tap the profile icon in the top right corner to access the Profile tab.

Step 2: Select 'eStatements and eAdvices'.

Step 3: Choose the account for which you want to retrieve your eStatements / eAdvice.

Step 4: You can use the 'Document type' or 'Period' filters to narrow down your search results.

Step 5: Open the available eStatement / eAdvice from your search results.

For iOS users: tap the button in the top right corner and select the location you want to save the file to. Your file will be saved there once you've made your selection.

For Android users: tap the button in the top right corner and your file will be downloaded automatically.

Protect your privacy and account. Keep any downloaded eStatements or eAdvices files in a secure location on your computer, and avoid using public computers to bank online.

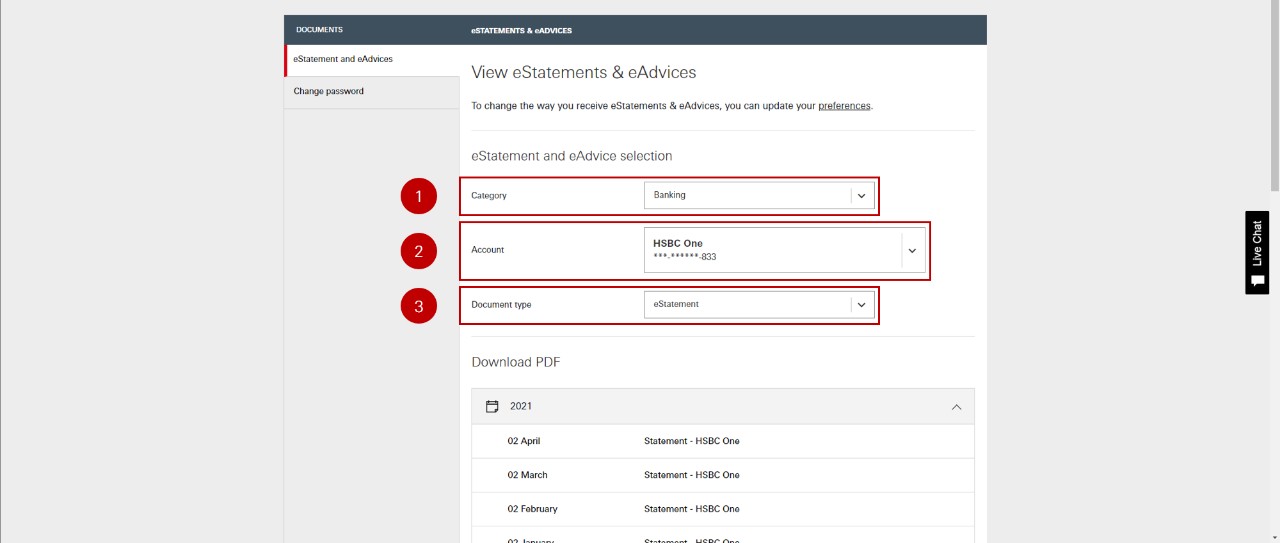

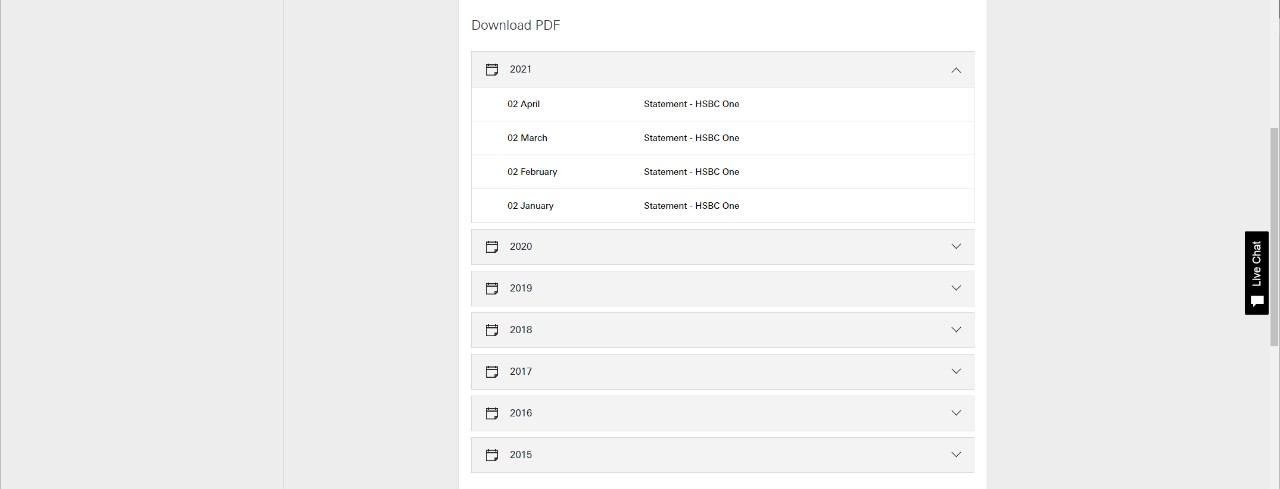

Step 1: Log on to HSBC Online Banking. Hover over 'Banking' on the top menu. Under 'eStatements & eAdvices', select 'View eStatements and eAdvices'.

Step 2: Filter to the account or accounts you'd like to see eStatements / eAdvices for by choosing the 'Category', 'Account' and 'Document type' you want from the dropdown selections.

Step 3: Scroll down and select the eStatement / eAdvice you wish to view. Once you select it, it will download automatically. By default, your statements will be displayed and sorted by year, then by date.

From 1 January 2013 to 31 December 2022, a Paper Statement Service Annual Fee of HKD20 is charged if customers request more than two paper statements per year. This applies to Personal Banking HK Dollar Current, SuperEase, HSBC Premier, HSBC One, Personal Integrated Account, University Student, Cash Card, Renminbi Savings, HK Dollar Statement Savings, CombiNations Statement Savings or Foreign Currency Current account(s).

Starting from 1 January 2023, a Paper Statement Service Annual Fee of HKD60 will be charged if customers choose to receive any paper statement in a full calendar year. This applies to Personal Banking HK Dollar Current, SuperEase, HSBC Premier Elite, HSBC Premier, HSBC One, Personal Integrated Account, University Student Account, Cash Card, Renminbi Savings, HK Dollar Statement Savings, CombiNations Statement Savings, Foreign Currency Current or any Credit Card account(s).

The fee is directly debited from your relevant account in the first quarter of the following year.

A portion of the collected fees will go to non-profit organisations for local community support, as well as driving our commitment to achieving a net zero carbon footprint by 2030. You can find out more about our sustainability strategy here.